An expat life can be adventurous, exciting and a dream come true for most of us.

But along with the unique experiences you experience in a new place, there are times you wish things happened the way they did back home.

This is especially true when it comes to handling money! The little conveniences that are taken for granted can become nuisances if you cannot access your money as quickly as you should.

Delayed Funds, No Fun!

One monetary annoyance is when expats receive checks from home country. These could be payments from an employer, social security, tax refunds, gift checks from friends and family, security deposits, freelance work income etc.

When living overseas, these have to be forwarded to the new home country, which can add many days/weeks until an expat has access to their funds. And sometimes even get lost in the mail, especially if you live in frontier locations or places where the mail delivery is not as professional. The process is something like this:

- Check is sent from Home (US/Overseas)

- Travels to new home location (say New Zealand)

- Deposited in the local NZ Bank Account

- Long clearing process

- Funds arrive and are accessible.

This is quite an extensive process which adds considerable time and delay in accessing funds. Even when the banking institution may be global, local country laws can prevent banks from acting like one entity for the user.

Check Deposit Options That Drain Funds

One way to get these funds is use methods like Western Union, exchange rate companies, PayPal payments etc. But all these options are very expensive when you add in the 3-5% fees they charge and then provide conversions to local currency at a mark-up. A check for $500 could easily see a fee of about $35 by the time you get the funds. That’s a rip off in my book for giving me my money.

Deposit Funds Locally With No Fees

The solution is to deposit checks locally within the home country. This would mean the funds clear quickly and are accessible upon depositing the check. You can then issue a bank withdrawal from anywhere in the world.

- Check is sent from Home

- Deposited in the local US Bank Account

- Fast clearing process and accessible.

How Local Deposit Works

One way to achieve this is to keep an address at your home location.

This can be done by using a family or friends address or using a professional mail forwarding company. The additional benefit of using a mail forwarding company is that they will provide a street address where you can receive your checks (and other mail) and in many cases, see the mail via a Virtual Mailbox. Many mail forwarding companies will deposit your checks for free or a small fee.

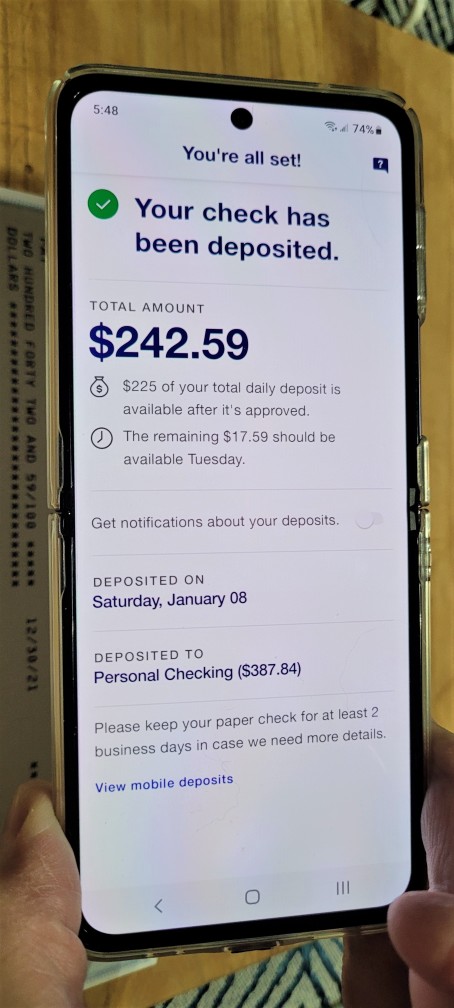

What About Mobile Check Deposits

Mobile deposit tools and technology are becoming a whole lot more accessible today than ever before.

Like every other industry in the world, banking is being completely transformed by the power of both the internet and our always on connectivity as well as the amazing capabilities that smart phones and other mobile devices put in the palm of our hands.

We’ve never had access to quite as much technology in our pockets as we do today. The smart phones we so often take for granted are thousands if not millions of times more powerful than the computers used to put men on the moon more than 50 years ago.

At the same time, mobile depositing (especially mobile check cashing) is still a relatively new technology that a lot of people aren’t completely comfortable with just yet.

There are still a lot of concerns when it comes to overall security anytime you are talking about banking online, and especially when you are talking about banking from your phone or tablet.

People are (understandably) also little bit nervous about these mobile deposits somehow getting lost in the shuffle, with people afraid that they will be missing out on the money than they would have deposited into their bank accounts with these paper checks just because of a glitch in the system.

Combine that with plenty of people that just aren’t super comfortable with crazy new technology in general and it’s not hard to see why so many remain a little bit hesitant to jump on board all that this amazing convenience has to offer.

You are interested in potentially going down this direction, though, you’ll want to zero in on the details we below.

Does Your Bank Offer Mobile Check Cashing?

Straight out of the gate you’ll first have to make sure that your banking institution offers mobile check-cashing and mobile check depositing to begin with.

Believe it or not, there are still a lot of banks that aren’t all that interested in moving everything to the digital world as rapidly as some other institutions – though most all banks are implementing at least some sort of online and mobile banking services, recognizing that this is what customers are expecting as a bare minimum from banks today.

A simple phone call to your bank or a look on their website (or in the app store) should clear this up for you pretty quickly. Bank employees will be able to let you know if mobile depositing checks or mobile check cashing is a possibility but they can also point you in the right direction to help you get the ball rolling, too.

Download the App

The overwhelming majority of banks that do offer this kind of service are going to facilitate it through their very own banking application.

You’ll need to first make sure that your bank has a mobile app available and then have to make sure that the mobile app is available for the operating system of your smart phone or tablet.

For the most part people are only choosing between Apple and Android devices, and banks almost universally applications on both of those platforms – on the Apple App Store and the Google Play Store, respectively – to cover all of their customers equally.

The installation is pretty simple and straightforward and you’ll be able to go through the same way you would any other app download.

From there you’ll need to make sure that you sign into your mobile banking capabilities through the application (potentially verifying your identity online and pairing it to the mobile app) but then you’ll be good to go.

Find the mobile check depositing and check cashing portion of the app, fire it up, and follow the on-screen prompts and everything else should sort of fall into place from there on out.

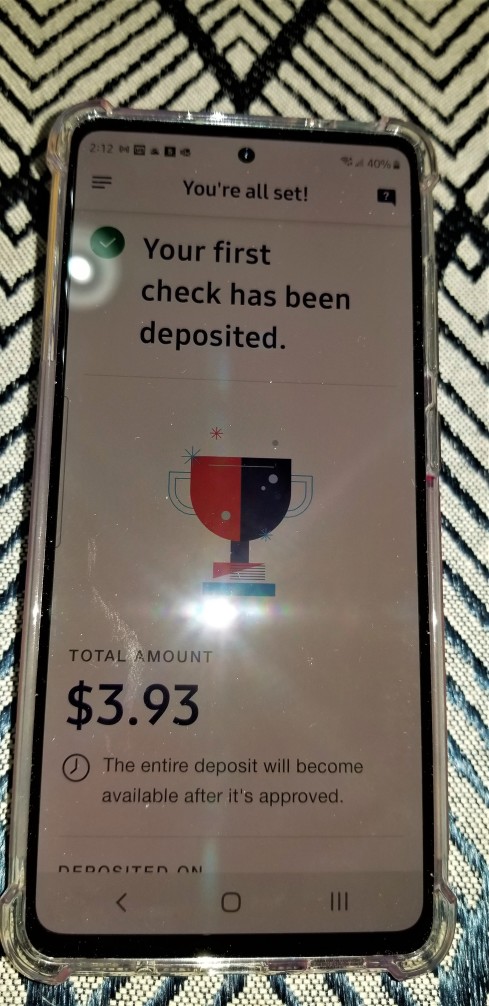

Keep a Copy of the Check

Of course, it is very important that you keep a copy of the check after you have gone through the mobile depositing process.

This is to make sure that you have a physical record of the check itself should something go a little bit sideways with your mobile deposit. It’s always a good idea to keep it in a safe location for at least a month or two (and maybe even longer if you have the space) just to be sure that you can furnish it should your banking institutions need to talk to you about the deposit for one reason or another.

It also might not be a bad idea to snap a picture of that check after you have deposited it (saving into your device or to your computer/cloud storage) just to make sure that you have a digital backup and copy you can share with these individuals or to keep in your permanent records, too.

…You Still Need the Check Physically, Though

The only wrinkle with mobile check depositing (especially when you are overseas or abroad) is that you actually need to get your hands on the check physically before you’re able to go through the mobile depositing process.

That’s never a problem if you’re at home and have access to your mail – but one when are traveling internationally, are spending some time abroad, or have moved permanently from your old address?

Then things start to get a little bit more difficult to navigate.

But that’s why services like US Global Mail are so valuable.

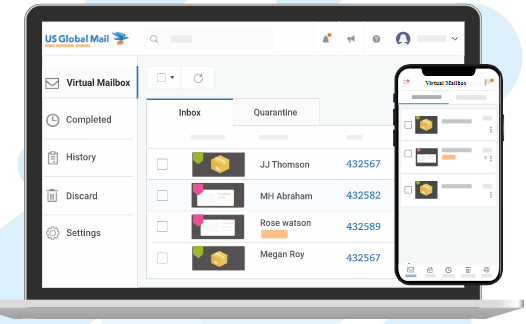

Get a Virtual Mailbox with Check Deposit Service

A virtual mailbox gives you a US address which can be used to receive your checks. US Global Mail, for example, offers a virtual address and mailbox and includes check depositing services as part of the service.

This service is hugely advantageous for people that wouldn’t have otherwise been able to cash physical checks while they are traveling overseas, a major problem for business owners and entrepreneurs that might have to spend extended amounts of time abroad but also need access to the money that they have coming in through the form of paper checks.

Check depositing services are available for all US Global Mail customers (at no extra charge) and are a safe and secure way to get the money you need deposited directly into your account with zero difficulty whatsoever.

One Stop Shop Solution

It’s as easy as 1- 2- 3.

For starters, customers that are already leveraging the mail forwarding or mail scanning service from this company are already going to have their checks handled by this organization – at least as far as scanning the original envelope and digitizing/recording that these checks were received is concerned.

The fact that this organization can then forward that check directly to your bank (any bank that accepts checks by mail) without you having to do absolutely anything is a huge advantage compared to many of the more cumbersome services out there that put a lot of hurdles in your way.

Easy and Effortless Workflow

As we just highlighted a moment ago, the whole process for having your checks deposited by US Global Mail is really easy and really effortless.

Every envelope containing a check that comes in will be immediately scanned and digitized just like every other pieces of mail that you have flowing through your account.

Then, depending on the information on that envelope – usually identifying information like bank name, address, etc. – an automated process will kick in where that check is then forwarded directly to your bank to be deposited.

You don’t have to do anything when you have this all set up through your administrative dashboard, either.

You don’t have to point that check in the right direction, you don’t have to tell US Global Mail to deliver it or to send it, and you don’t even have to sign the check for it to be deposited!

Instead, that check – still securely inside of its original envelope, never having been opened and never having been handled physically by your mail scanning/forwarding service – is sent directly to your bank to be processed and deposited into your account, complete with digital records tracking everything every step of the way.

It doesn’t get much better than that.

Check Out US Global Mail Today

At the end of the day, there’s a reason why so many people (particularly entrepreneurs and business owners) choose US Global Mail to handle all of their mail scanning, mail forwarding, and check depositing needs.

One of the most trustworthy and reputable companies in this industry, this organization has a long track record of success and a reputation taking care of their customers and clients above and beyond the industry norm.

On top of that, a number of different solutions and services are available directly from this company at a whole range of price points – with mail scanning, forwarding, and check depositing solutions available to fit every budget imaginable.

For more information and details, visit US Global Mail today.